Creating passive income through real estate is a powerful way to build wealth over time. While it often requires upfront effort or investment, once the right systems are in place, the income can be relatively hands-off. Whether you're a beginner or looking to expand your portfolio, here are the most popular and practical ways to generate passive income in real estate.

Owning rental properties is one of the most common paths to passive income. After purchasing a property, you can rent it out to long-term tenants. Income is generated monthly, and over time, the property may also appreciate in value.

Pros:

Predictable cash flow

Property value appreciation

Tax benefits

Cons:

Requires maintenance and management

Tenant turnover and vacancies

Hiring a property manager can help make this income stream more passive, especially if you own multiple properties or don’t live nearby.

If you own a property in a desirable location, short-term rentals can be a lucrative source of income. Platforms like Airbnb and Vrbo make it easier than ever to rent out your space.

Pros:

Higher potential income than long-term rentals

Flexible usage of the property

Cons:

Requires regular cleaning and guest communication

Local regulations may restrict short-term rentals

Automation tools and co-hosting services can help reduce the workload, making short-term rentals more passive.

REITs are perfect for those who want to invest in real estate without owning physical property. A REIT is a company that owns, operates, or finances income-producing real estate. You can invest in publicly traded REITs through the stock market.

Pros:

Low barrier to entry

Highly liquid (can be bought/sold like stocks)

Dividends provide passive income

Cons:

Limited control over investments

Subject to market volatility

Crowdfunding platforms allow you to invest in large-scale real estate deals with other investors. This hands-off approach gives access to commercial properties, apartment buildings, and more.

Pros:

Diversified investment opportunities

Low entry minimums

Hands-off management

Cons:

Limited liquidity

Investment risk based on project success

Popular platforms include Fundrise, RealtyMogul, and DiversyFund.

If you own vacant land, you can lease it to farmers, utility companies (for cell towers or solar panels), or other businesses. This requires little to no ongoing effort.

Pros:

Minimal maintenance

Long-term contracts provide stability

Cons:

Income depends on location and land use

Buy, Rehab, Rent, Refinance, Repeat (BRRRR) is a strategy where you buy undervalued properties, fix them up, rent them out, then refinance to fund the next deal. While active at the beginning, it becomes more passive over time.

Pros:

Builds equity quickly

Allows you to scale your portfolio

Cons:

Requires upfront capital and effort

Market conditions affect refinancing ability

If you have capital but not time (or vice versa), consider partnering with others. You can be a silent partner while someone else manages the day-to-day operations.

Pros:

Leverage other people’s skills and time

Share responsibilities and risks

Cons:

Requires clear agreements and trust

If you're buying a home in Brantford or Brant County, consider looking for one with a finished or partially finished basement. With some thoughtful upgrades and the proper permits, that space could become a legal secondary suite—perfect for long-term renters such as students, young professionals, or retirees.

That extra unit could generate monthly income that helps cover your mortgage, property taxes, or even fund your next investment. You don’t need a duplex or a large portfolio to get started—just one well-located home with rental potential can kickstart your journey toward financial freedom.

An Additional Residential Unit (ARU) is a separate, self-contained dwelling that is secondary to the main home on a property. These units can be attached (like a basement apartment or in-law suite) or detached (such as a tiny home, garage apartment, or converted outbuilding). They're a great way to create passive income while increasing the functionality and value of your property.

Common examples of ARUs include:

Basement apartments

Granny flats

Coach homes

Garage lofts or apartments

Modified shipping container dwellings

Tiny homes on a foundation

In-law suites

Whether you're eligible to add an ARU depends on several local factors:

Servicing: Properties with municipal water and sewer are often more flexible than those on well and septic systems.

Zoning: Your property must meet zoning requirements for lot size, setbacks, parking, and density.

Type of ARU: Requirements vary based on whether the ARU is attached (e.g., basement apartment) or detached (e.g., coach house).

Before starting construction, it's important to check with your local planning department or building department to confirm what’s allowed on your property. In Brantford and Brant County, there are guidelines to help homeowners navigate this process—and even potential grants or incentive programs depending on your project type.

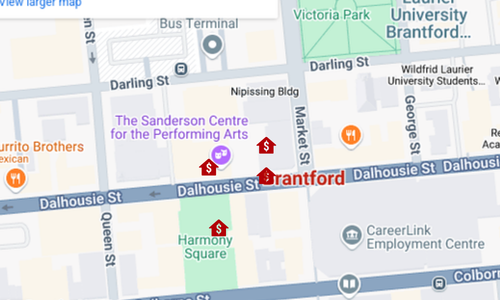

In Brantford and Brant County, real estate investors are increasingly drawn to:

West Brant for its family-friendly neighborhoods and newer homes with basement apartment potential.

Downtown Brantford, where affordable multi-family units are in demand among students and young professionals.

Paris and St. George, which offer small-town charm and strong short-term rental appeal.

Zoning by-laws in many parts of Brant County also allow for accessory dwelling units (ADUs)—a great option for creating passive income without buying a second property.

To keep your real estate investments as passive as possible, the right tools make all the difference. Here are a few recommendations:

Buildium or Hemlane: Property management software that handles rent collection, maintenance requests, and tenant communication.

Hospitable or Airbnb’s built-in tools: Automate messaging, booking, and guest instructions for short-term rentals.

BiggerPockets’ Rental Calculator: Run cash flow projections before buying to ensure profitability.

These tools help save time, avoid stress, and maximize returns.

New investors often fall into a few avoidable traps when trying to generate passive income:

Underestimating expenses like repairs, vacancies, and insurance.

Overleveraging with too many mortgages or high-interest loans.

Choosing the wrong location, leading to tenant turnover or low rental demand.

Failing to screen tenants properly, which can lead to late payments or damage.

Doing your due diligence—and working with a knowledgeable real estate professional—can help you sidestep these issues from the start.

Passive income from real estate doesn’t just come from rent—it also comes from tax advantages. Investors can benefit from:

Depreciation: Deduct a portion of the property’s value each year.

Mortgage interest deductions

Capital gains treatment on long-term property appreciation

Always consult with an accountant or tax professional to ensure you're maximizing your tax savings based on your investment structure and goals.

Getting started with passive real estate income doesn’t have to be overwhelming. Here’s a simplified roadmap:

Save for a down payment—typically 20% for investment properties.

Research locations with strong rental demand and low vacancy rates.

Run cash flow projections to ensure profitability.

Get pre-approved by a lender experienced with investment properties.

Work with a real estate agent who understands the investment market.

Purchase the property, set up systems, and start generating income.

Take it one step at a time—every action you take moves you closer to financial freedom.

Whether you’re ready to buy your first rental property or want help analyzing a potential short-term rental, I’m here to guide you. I specialize in helping investors find the right properties in Brantford, Brant County, and surrounding areas.

Let’s chat about your goals—and build a passive income plan that works for you! Fill in the form below and lets get starter