Real estate comes with its own language, and if you’re new to buying or selling a home, it can feel overwhelming. From contracts to closing, you’ll hear terms that may not come up in everyday conversation—but they’re important to understand.

Whether you’re navigating the Brantford real estate market, looking at homes for sale in Brant County, or preparing to sell your property anywhere in Ontario, knowing these words can help you feel more confident throughout the process.

Here are 12 real estate words you should know—explained simply, with examples.

Meaning: A personal possession or property other than real estate; not attached to the home itself.

Examples: Area rugs, some appliances, drapes

You Should Know: These items can easily be mistaken for fixtures. To avoid confusion, they should be clearly written into the contract by name and description.

Meaning: An item that is physically attached to the property and considered part of the real estate.

Examples: Light fixtures, built-in shelving, bathroom vanities

You Should Know: Fixtures typically stay with the home when it’s sold unless specifically excluded in the contract.

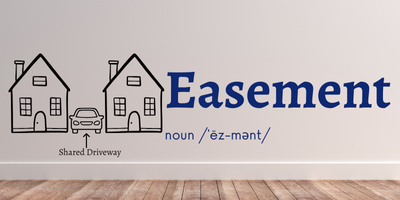

Meaning: A legal right for someone else to use part of your property for a specific purpose.

Examples: Shared driveway, utility access, pathway to a neighbouring lot

You Should Know: Easements can affect property value and use, so it’s important to review them before purchasing.

Meaning: An offer to purchase a property that only becomes binding if certain conditions are met.

Examples: Financing approval, home inspection, sale of the buyer’s current home

You Should Know: Conditions protect both buyers and sellers, and timelines for fulfilling them should always be clear in the agreement.

Meaning: When a structure on one property extends onto another person’s land without permission.

Examples: Fences, sheds, driveways crossing property lines

You Should Know: Encroachments can cause disputes and may need to be resolved before closing.

Meaning: Ownership of both the property and the land it sits on, with full control (subject to local laws).

Examples: Detached homes, rural properties, some townhomes

You Should Know: Freehold properties often come with more responsibilities like maintenance and repairs compared to condominiums.

Meaning: A type of property where you own your individual unit but share ownership of common areas.

Examples: High-rise apartments, townhouse-style condos, loft buildings

You Should Know: Condos usually have monthly fees that cover shared expenses like maintenance, insurance, and amenities.

Meaning: A tax paid to the provincial government when real estate is purchased.

Examples: Ontario Land Transfer Tax, Municipal Land Transfer Tax (Toronto only)

You Should Know: First-time buyers in Ontario may qualify for rebates to reduce this upfront cost.

Meaning: The legal document proving ownership of a property.

Examples: Freehold title, joint title, tenants in common

You Should Know: Your lawyer will conduct a title search before closing to ensure there are no liens or claims against the property.

Meaning: An unbiased estimate of a property’s fair market value, usually completed by a professional appraiser.

Examples: Mortgage lender appraisal, private appraisal

You Should Know: Lenders often require appraisals to confirm the home’s value before approving financing.

Meaning: A sum of money paid by the buyer when making an offer to show good faith.

Examples: 5% of purchase price, certified cheque, bank draft

You Should Know: The deposit is held in trust (usually by the listing brokerage) and goes toward the down payment on closing.

Meaning: The expenses in addition to the purchase price that buyers and sellers must pay at closing.

Examples: Legal fees, land transfer tax, title insurance

You Should Know: Buyers should budget 1.5–4% of the purchase price to cover closing costs.

Understanding these terms is especially important in a competitive market like Brantford and Brant County. When homes sell quickly, being prepared with the right knowledge helps you move with confidence. Whether you’re a first-time buyer in Ontario or planning to sell your family home, knowing what these words mean can save you from surprises and make the process smoother.

Thinking about buying or selling in Brantford or Brant County? I’d be happy to walk you through the process and make sure you feel informed every step of the way.

Reach out today—I’m here to help you with all things real estate in Ontario.